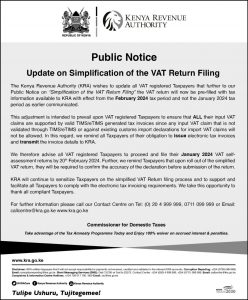

Kenya Revenue Authority (KRA) has announced a crucial update in the VAT return filing process. Starting February 2024, VAT returns will be pre-filled with tax information, deviating from the previously communicated date of January 2024.

This adjustment is implemented to ensure that every VAT claim is substantiated by valid TIMS/eTIMS-generated tax invoices. Any input VAT claim lacking validation through TIMS/eTIMS or against existing customs import declarations for import VAT claims will not be allowed.

All taxpayers must issue electronic tax invoices and transmit the invoice details to KRA, fostering seamless validation of VAT claims during the filing process.

To maintain compliance, VAT-registered taxpayers are advised to file their January 2024 VAT self-assessment returns by the deadline of 20th February 2024. This timely filing ensures adherence to compliance protocols and prevents potential penalties.

Upon the rollout of the simplified VAT return, taxpayers will be mandated to confirm the accuracy of their declarations before the formal submission of the return. This additional step reinforces a commitment to precision in reporting and enhances accountability.

KRA is dedicated to sensitizing taxpayers on the simplified VAT return filing process and providing continuous support to ensure seamless compliance with electronic tax invoicing requirements.

In conclusion, these updates underscore KRA’s commitment to enhancing transparency and efficiency in the VAT return process. Adapting to these changes is essential for businesses, ensuring they stay informed and compliant with the revised pre-filling, e-invoicing obligations, and upcoming deadlines.